I've always thought that Zomato's business is so easy- it's just food delivery, right? Even McDonalds and Domino's do that. Zomato hasn't done anything revolutionary.

I was so wrong. As I read Zomato's IPO document(DRHP), I realized how incredibly difficult Zomato's business is. And it's so much more than "just food-delivery".

So in today's article, we will try to understand Zomato's business, and what makes it so revolutionary.

Hi friends I’m Shreyans👋 and welcome back to my newsletter Integral🕹- a place where we get smarter about the Indian tech industry.

I crossed 1000 subscribers on my newsletter last week!!!!!! A big thanks to all of you for supporting me🙏🙏

If you’re new here, please subscribe- it’s free!

Let’s go🚀🚀

🕹Zomato’s business model- Marketplace

All of us know that Zomato doesn’t own any restaurant or employ any drivers. So why are so many restaurants and drivers on its platform? That’s because it has built a strong “marketplace” to attract restaurants and drivers.

So what is a "marketplace"? Just look at Amazon. Or Flipkart. They are the best examples of a marketplace. Shopkeepers sell their goods on Amazon/Flipkart, and we buy them. That's a marketplace- it is the intersection of 2 different markets: people(the consumer market), and shopkeepers(3rd party seller market).

Think about it- earlier this whole market was very disorganized. Amazon and Flipkart organized it. But they don't own any goods themselves- they simply act as the medium between shopkeepers and customers.

Similarly, the food delivery sector was very disorganized. But Zomato organized it by acting as a medium between people, restaurants, and drivers.

This is what makes Zomato's business incredibly hard- instead of the usual 2 markets, it has combined 3 markets- customers, delivery partners, and restaurants into a single marketplace.

Companies that are marketplaces are one of the most valuable in the world today. The best thing about a marketplace is its defensive power- it is very difficult to scale or compete against a marketplace.

Now you understand why Zomato is so different from Domino’s or McDonald's. For these companies, the main product is pizza and burger. But for Zomato, the main product is the 3-sided marketplace.

Now, there is one golden rule for any marketplace- the better you serve the individual markets, the stronger the marketplace becomes. Let's see how Zomato benefits each market in its marketplace-

Customers: This should be easy lol. Zomato(and Swiggy) has turned all of us into food-delivery junkies. I see 2 main benefits that Zomato provides us-

Food delivery- no need to go outside and eat. Just order the food. It's convenient. And cheap!

Wide variety- lots of restaurants, lots of choices for us.

Benefits of its premium membership- Zomato Pro

Clearly, people like these benefits because 10.7 million customers ordered food every month on Zomato last year. And this number has been increasing for the past several years, a positive sign.

Restaurants: Again, huge benefits for this market. With minimum extra effort, restaurants get more orders using Zomato. They don't have to hunt for more customers, and they don't have to worry about food delivery. Sweet business! Last year, Zomato had around 3.5 lakh restaurants on its platform. Restaurants get other benefits as well- ads, Hyperpure, etc.

Delivery partners: This is actually a controversial market- Zomato heavily relies on these delivery persons to attract both restaurants and customers. But it doesn't give them the status of employees. This is necessary for Zomato to preserve the unit economics of its business. Zomato had 1.6 lakh delivery guys last December.

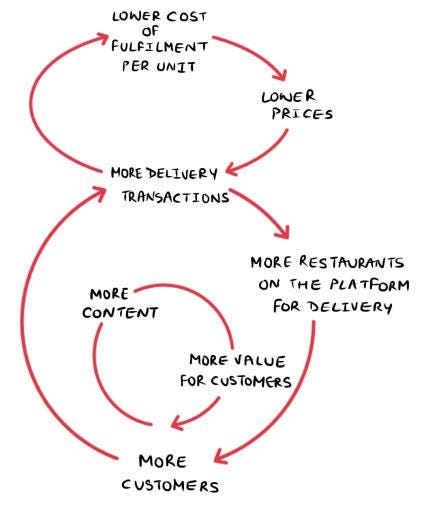

Look at this diagram below- it shows how interconnected and powerful Zomato's 3 components are. Whenever any part of this cycle gets stronger, the whole cycle gets stronger. This is what makes a marketplace a very strong business model.

A lot of people don't understand why tech companies command such high valuations despite huge losses. Check out this article by Harvard Business Review- it says that tech companies have intangible assets(like Zomato's marketplace, customer relationships, etc.) that can't be captured in a traditional financial statement.

🕹Problems with food delivery:

Above, I explained why Zomato is so different from Domino's and McDonald's. But there is one similarity between the companies as well- food delivery.

For both Zomato and Domino's, food delivery is an important feature. In fact, for Zomato, the entire purpose of the marketplace is food delivery. The power of this 3-sided marketplace ensures that food delivery is handled beautifully.

The picture, however, isn't as rosy as it seems. Even a strong 3-sided marketplace can't conquer something as difficult as food delivery.

Surprising isn't it? Food delivery is just picking up the food from the restaurant and giving it to the customer. How difficult can that be?

It is a marvel that the consumer gets a burger delivered direct to door and the order is profitable.

The quote is by some famous economics guy. It captures the central problem with food delivery- it's very difficult to make a profit.

From 2018 to 2020, Zomato's revenue increased 5x but its expenses increased 8x. And the bad news doesn't stop here- in the IPO filing, the company has said that the losses will keep on increasing for the next few years😔

Here's why-

1. Competition

Remember my Paytm article where I said people weren't loyal to one payment app like PhonePe or Paytm or GPay. Food-delivery companies face the same problem.

Whichever food-delivery app gives the most discounts, people start using that. It is too easy for customers to switch food-delivery apps, and it’s very easy to try out new apps.

And all the food-delivery apps achieve the same goal- food delivery, so there is no difference between 2 food-delivery apps.

Just try to recall the food-delivery apps a few years back- Dazo, Spoonjoy, Eatlo, TinyOwl, UberEats, Foodpanda. But now, most of them are closed or acquired. Only 2 players remain- Swiggy and Zomato.

Too much competition → less margins → huge losses → extinction

2. Negative Unit Economics

Unit Economics is used to determine how much money Zomato makes on each order.

Bad news- Zomato was losing money on each order till the end of 2020.

However, a wonderful thing happened this year- the company earned Rs. 22 for each order. 2 main reasons for this- 1) revenue📈 through increasing AOV owing to the pandemic and 2) premium restaurants listing on Zomato which has thereby improved AOV (Remember, Zomato earns a commission as a % of the order value) and through reduced discounts.

But once the pandemic gets over, can Zomato maintain this positive unit economics?

🕹Zomato’s solution to the unprofitable food delivery business:

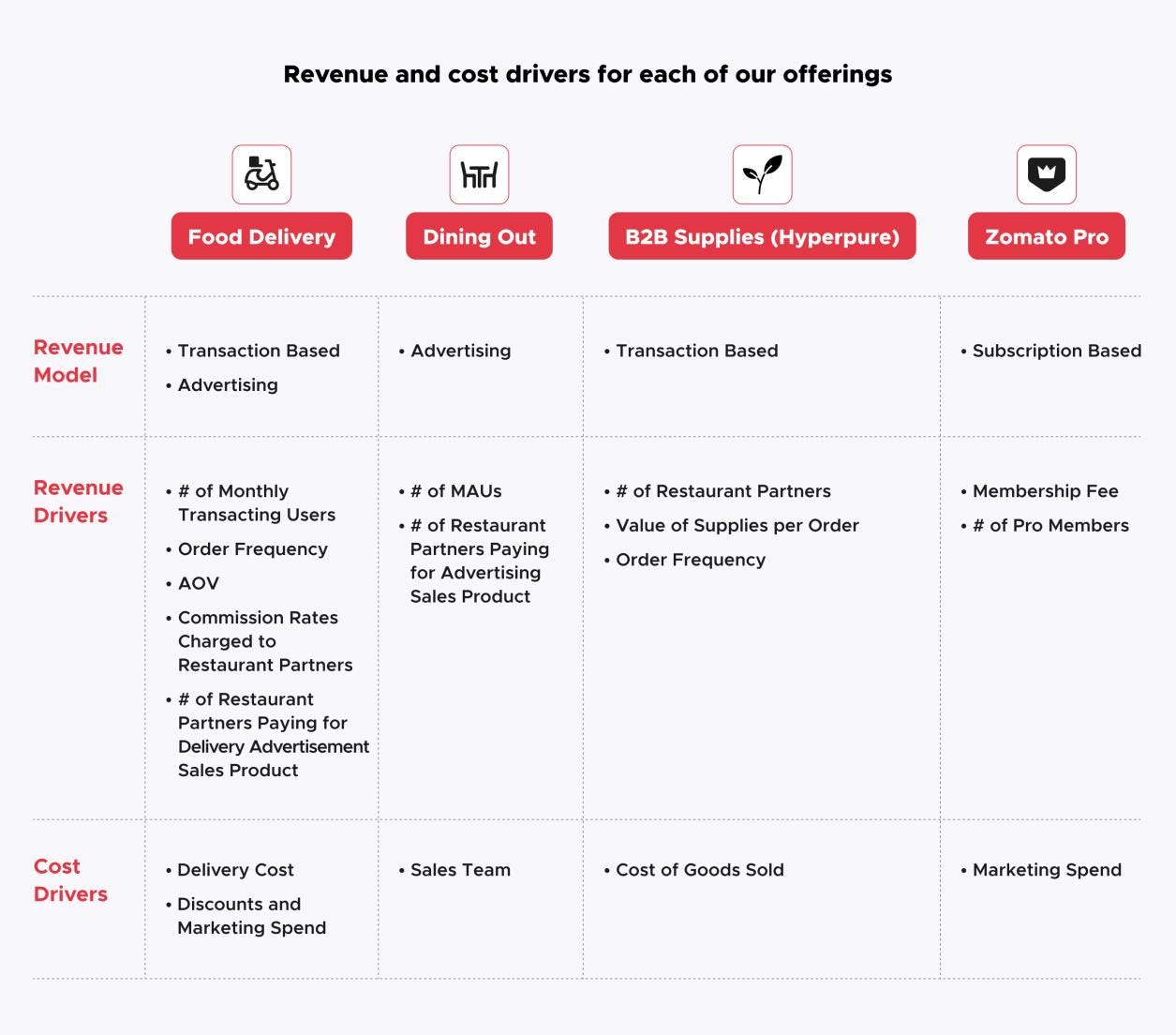

You get the point- Food delivery is not so profitable. The economics is very fragile. Even a slight change in any factor will totally upset the food-delivery business. So how did Zomato grow its business? It came up with a vertically integrated model to increase its revenue and cover its food-delivery losses. There are 3 aspects to this model-

Dining-out- where Zomato mainly earns revenue through advertisement

Hyperpure- supplying raw materials to restaurants.

Zomato Pro- Zomato premium membership. It includes both food delivery and dining-out.

If you look closely, you'll realize that Zomato's strategy involves dominating not only the food delivery space but the entire food delivery and dining market, right from the supply chain (HyperPure) to the last mile delivery (food delivery)!

🕹Zomato’s future- The Way Ahead🚀🚀

Despite the problems mentioned, I think Zomato has immense potential and opportunities to grow in the future. Not convinced? Just look at the chart below.

India has a long way to go in terms of internet penetration as compared to countries like China and the USA. Moreover, the online food delivery market constitutes only 10% of the total food consumption market!! And only 9% with access to the internet use online food delivery services!!

The Covid-19 pandemic has caused a significant change in the financial metrics of Zomato, initially bringing a sudden decrease in business and then, after the restrictions were eased, being the main reason why Zomato recorded the highest growth in a particular quarter.

Also, this explains why Zomato has put such a huge number in its potential market size- $65 billion. It represents an immense untapped market waiting to be taken advantage of.

With such a huge potential, is it any surprise that Zomato is one of the most valuable tech companies in India?

I hope you found this article insightful! Please share it with your friends, I’m sure they will also find it informative!

Thanks to Adwait Pisharody for helping me understand Zomato’s IPO doc and his valuable inputs to today’s newsletter.

All the data and diagrams have been taken from Zomato’s Draft red Herring Prospectus.

Thanks for being a supporter!

Bye-bye and see you next week!

Also, Zomato or Swiggy can do one extraordinary thing to increase its Revenue.

It can bring out a Party feature for people living in different cities and coming up for an online Party on Google Meet or something.

They would essentially take a CSV of names, orders and Addresses and then deliver the food hyperlocally.

Really impressive analysis, just loved it 💯🔥🤍