Today's newsletter is sponsored by:

I have sad news for you, my friends. We are facing a new pandemic.

This new pandemic is: TOO MANY CHOICES FOR INVESTING.

Stocks. FDs. Mutual funds. Crypto. F&O. NFTs. Metaverse. Real estate. There are soooo many choices for investing.

How can noobs like us decide where to invest?

That’s why I liked Mintd’s idea so much.

Mintd is a digital wealth manager for every Indian.

They use Nobel Prize-winning Modern Portfolio Theory to invest your money: diversified, low risk, high reward. You just have to sit back and watch your money grow.

Sounds good, right?

So the story starts in August. Some people at RBI were theoretically discussing how to turn UPI into a paid service. This was a purely theoretical discussion. The people at RBI do many theoretical discussions like this. The purpose is to prepare for the future. Suppose that after 2 years, fintech companies and banks absolutely refuse to run a free UPI, then the head of RBI's UPI department won't be out of ideas. He will simply pull out the meeting notes from 2 years ago and read the ideas discussed in that meeting. Then, he will confidently call the RBI governor and tell him about a brilliant idea he just had. Thus, the theoretical meeting 2 years ago saved his job. Yay theoretical meetings!

The problem is, sometimes theoretical meetings leak to the people. And people panic.

Anyways, RBI's “UPI as a paid service” meeting leaked. And people panicked.

Not that I blame the people for panicking. UPI has become such an integral part of our lives that if I suddenly hear the news that UPI will be paid, of course I will panic. We don't think of UPI as a product or a service, its more like a public good. I mean, the confidence with which we leave the house without carrying a wallet or ask the shopkeeper for QR code is amazing. In fact, shopkeepers who don't accept UPI are frowned upon. Full credit for bringing this huge behavior change goes to UPI. UPI hooked people because of its simplicity and convenience and brought a cashless revolution to our country. UPI's rapid growth over the years proves this: from 30 million transactions in August 2016 to 1 billion transactions 3 years later in October 2019 to 6 billion transactions in July 2022. The total value of transactions in July was a mind boggling ₹10.62 trillion!! Heck, not just us, even other countries are amazed by UPI. We have expanded UPI to Bhutan, Nepal, France, etc

Soooooooo much good stuff. For free. So of course people will panic if you say that they will have to pay for this stuff. Its like being asked to pay to enter a park or garden. Even if don’t count the goodness of UPI, paying for a “payment method” seems weird, doesn’t it? For example, if I confidently leave my house without my wallet and confidently ask for a QR code at the restaurant and the waiter confidently informs me of a 5% extra charge for UPI, it will be a pretty rude shock. I'll probably be thinking, money is money, cash or UPI, why do I have to pay 5% extra for UPI, I wish I had brought my wallet. But anyways it doesn't matter in this case, I'll have to pay the 5% extra because I don't like washing dishes at restaurants. A lot of people pictured a similar scenario in their heads and realized that they don't want to wash dishes at restaurants and more importantly, don't want to pay for UPI. These people created a furor on social media, and it became one of those social media controversies where everyone is passionately shouting at the top of their voices and no one is listening to each other and after a while no one remembers what they were shouting about and newspapers are dutifully reporting each and every rumour just to keep the confusion going. In the middle of the panic and social media controversy, RBI tried to defuse the rumors by saying that it was just a theoretical discussion, but heck, by that point social media was too busy in shouting, and RBI's logical explanations were ignored.

Anyways, the situation got so out of hand that Finance Minister Nirmala Sitharaman had to come forward and say, hey guys sorry for the confusion, you know what, RBI is an idiot don't listen to them, UPI will remain free.

She was pretty confident about the "UPI will remain free" sentence because she herself had announced that govt will give 1500 crores to fund UPI. She had done the same announcement last year, and she will probably do the same thing next year as well. You see, for the govt, UPI is part of a bigger mission: promote online payments and reduce cash payments. Why? Maybe because most criminal stuff takes place through cash, and online payments would make it more difficult for criminals. I'm sure there are a lot of other reasons as well, but this is the one that comes to my mind on 9th October 1:09 am. UPI has done wonders for this mission. It convinced so many people to make online payments, and so many transactions now happen online. If UPI would be paid, such mass adoption wouldn't be possible. In fact, banks and fintech companies used to charge for UPI transactions. The charge was Rs. 0.25 for transactions worth below Rs 1,000, Rs 1 for transactions worth up to Rs 25,000 and Rs 5 for transactions worth up to Rs 75,000. But then in 2020 govt said, no need to charge for UPI, let it remain free; whatever the cost you guys incur for running UPI, we will fund that.

This move truly accelerated UPI. UPI adoption grew so much after this move that banks' servers couldn't handle it. This increased UPI downtime increased significantly. That's why govt is happy to keep funding UPI instead of charging users: they want UPI to keep growing. They are afraid that a paid UPI will slow down adoption. Govt will also keep funding UPI in the near future because the cashless revolution isn't complete. A lot of people don't have internet or smartphones, and they use cash. To target these people, UPI has launched UPI123: no internet or smartphone needed, just a dabba phone with a sim card. Also, UPI is a bragging point for the govt: Oh look, we built this amazing technology and it has brought millions of Indians online and brought a cashless revolution and a fintech revolution and btw did we mention that we are exporting it to other countries as well.

Govt thought that funding UPI = problem solved. Nope. Here's what actually happened. Govt filled a big bag with money and dropped it on the UPI office. The UPI people sent it to the banks. Banks were supposed to send an equal share to their fintech partners, but they forgot. They received the funding meant for fintechs and kept it.

Fintechs didn't like this. They had spent a lot of money to bring people to UPI. This was actually very important for UPI's mass adoption. We think that UPI was made and magically everyone started using it. Nope. Someone had to do the hardwork and convince people to try this new thing. Fintechs did it. They invested a lot of money on UPI: marketing campaigns and ads and cashbacks and diwali stickers and stuff. Sure, they weren't doing it for some noble reasons. They wanted returns from their huge investments. They wanted UPI to become a profit machine for them. They made some revenue through fees on UPI. But it wasn't enough. As UPI grew more popular, the cost of running UPI went up. And then govt took away that revenue source when they banned fees on UPI. So fintechs had to improvise. Since they couldn't use UPI as a direct source of revenue, they started using it indirectly. They added new services like lending so that people who came to their app for UPI saw the lending option and used it. But it wasn't enough. By this time, UPI had become crazy popular, and the cost of running the system was too high. So fintechs wanted to turn UPI into a paid service. So they went crying to RBI. And RBI started the theoretical discussion. And then govt said no need for paid UPI, we will give funding.

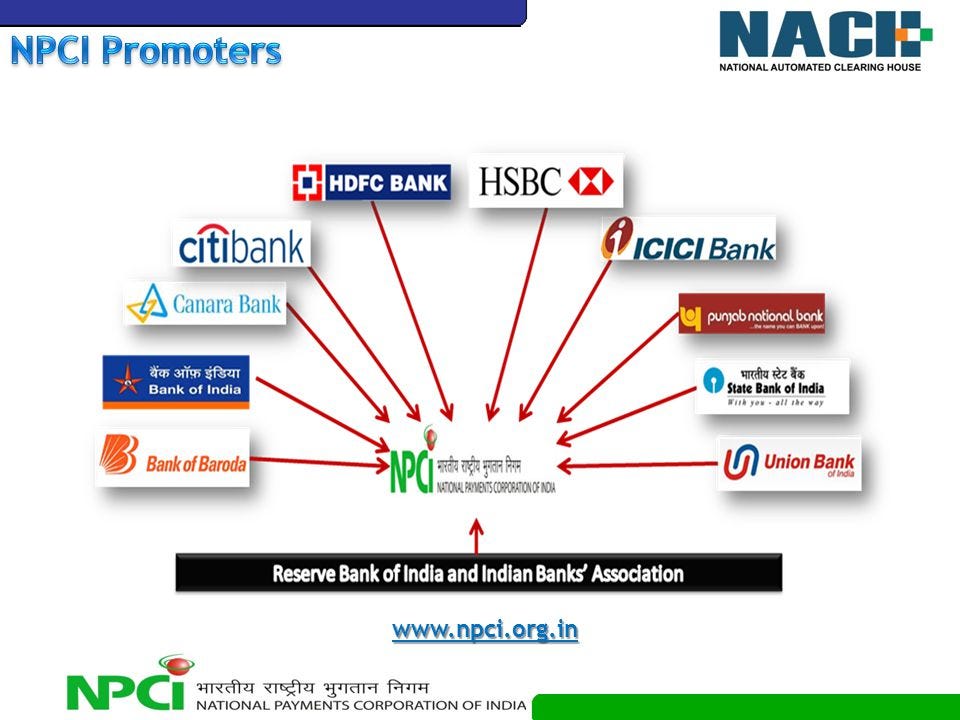

But govt funding is not the solution. We need fintechs to keep running the UPI system. If fintechs lose interest in running UPI, it will be hell. Banks don't know shit about modern tech. They'll just wipe out all the hardwork done by fintechs and govt over all these years. If you want fintechs to keep running such a massive system, you have to incentivize them financially. We must give them opportunities to make money through UPI. Govt funding is not the solution because it will only cover the fintech's cost, but it won't turn UPI into a profit machine that fintechs are hoping. And hey, it's not as if fintechs are actually getting govt funding, banks are eating all of that. And hey, govt funding for UPI comes from taxpayer money, so ultimately we are paying for UPI, right? Fintechs want UPI to turn into a profit machine, so let them turn it into a profit machine. Turn UPI into a paid service. It will incentivize fintechs to keep investing and innovating in UPI, which will be great for UPI. NPCI is launching a ton of new UPI features, but it needs the support of fintechs to take it across the country(for example, it will be interesting to see how cred will take advantage of the UPI-credit card thingy).

That's why I think that UPI cannot remain free. It must be turned into a paid service.

Next question: how?

This is tricky. The smart people at RBI said that because UPI is basically transferring money between bank accounts, it is like IMPS so its charges should be like IMPS. If I'm making a payment to you through IMPS, I'll be charged a transaction fees depending on the amount. There's different tiers of amount, like below 1K, 1K to 1L, above 1L and each tier has a separate charge. But I don't think we should use this method in UPI. Firstly, this tier system will create a lot of confusion. People will always be trying to figure out which tier they fall into and how they can avoid it. Second, only charging the person who makes the payment will introduce friction. People will try to avoid being the person who has to make the payment. Whenever they have to pay someone, they will take out their UPI scanner, then remember about the fees, put the phone back inside and take out cash. As you can see, this is discouraging people from using UPI, so not a good solution. Another idea is to ask people to pay a monthly subscription for UPI. Again not a good idea. Only a few people will buy it. Remaining will prefer cash. Now, for those who have bought the subscription, UPI is of little use to them because very few of their friends are paying the subscription, rest all are using cash. As a result, slowly the subscribers will also be forced into cash. And UPI will be negatively impacted. These are the 2 methods of turning UPI into a paid service by asking people to pay. Both of them are bad.

The best idea so far is to ask merchants to pay to use UPI. They'll gladly pay because they really need it. People find UPI very convenient, so order conversion rates will be higher when paying through UPI. Merchants can be charged for this benefit. They already pay fees when someone pays them using credit card or debit card. It's around 2% of the transaction fees. Maybe the same fees can be done for UPI. Banks and fintechs can divide the fees among themselves. Banks love merchant fees because it is very lucrative: that's why credit card is such a profit machine for banks. If done correctly, UPI fees for merchants can be the same for fintechs. And fintechs will keep working hard to make UPI better. And we won't need the govt to spend our money to fund UPI.

Note: RBI's theoretical discussion didn't actually leak. The discussion paper was posted publicly on the website, along with thousands of other boring documents. But this particular paper had the scariest title: Charges in Payment Systems, which is why it caught the attention of so many people.

This wraps up today’s newsletter. I hope you enjoyed reading it. Please share your feedback:

Or you can just reply back to this email and let me know your thoughts.

Please share this article with your friends, I’m sure they will also enjoy reading it:

And if you’re new here, please subscribe- you get weekly insights on the Indian startup ecosystem:

Thanks for reading this newsletter! Bye bye and have a great day!

Thankss for sharing this information!

Love the way you narrate your newsletters.

Insightful as always!💡

I liked the humor element in this article. I think this form suits you Shreyas.

But... a bad idea to make UPI a paid service, even for Merchants. Do you know how many times I have switched from a CC to a Debit card or even cash when I was told it will be charged 2% extra? I'm sure a lot of us Indians have. It will again drive negative growth for UPI.

The best way the Govt. can make money from UPI is licensing it to other countries, which it probably is and hence it's not a cash hole like you think, but already a money-making machine.