As I was reading up about BharatPe, I realized one thing: these people know their customers. Like really know them.

They started with giving QR codes to shopkeepers. But they knew that shopkeepers would never pay for QR codes. So they started selling the one thing that shopkeepers would definitely pay for: loans!

In today's article, we will take a deep dive into this ambitious startup-from QR codes to lending money to buying a bank.

Hey friends, I’m Shreyans, and welcome back to Integral🕹- a place where we get smarter about the Indian tech industry!

Understanding BharatPe meant understanding lots of finance and fintech concepts. I’d like to thank Adwait Pisharody and Yash Agarwal for patiently explaining all the concepts to me!

If you’re new here, please subscribe- it keeps me motivated to write better content for your people!

Let’s go🚀🚀🚀

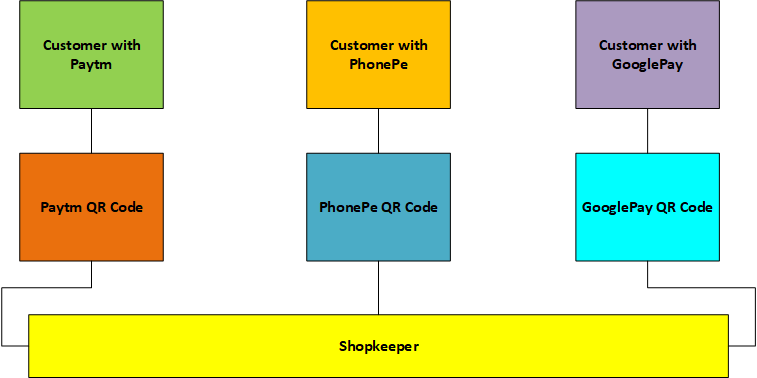

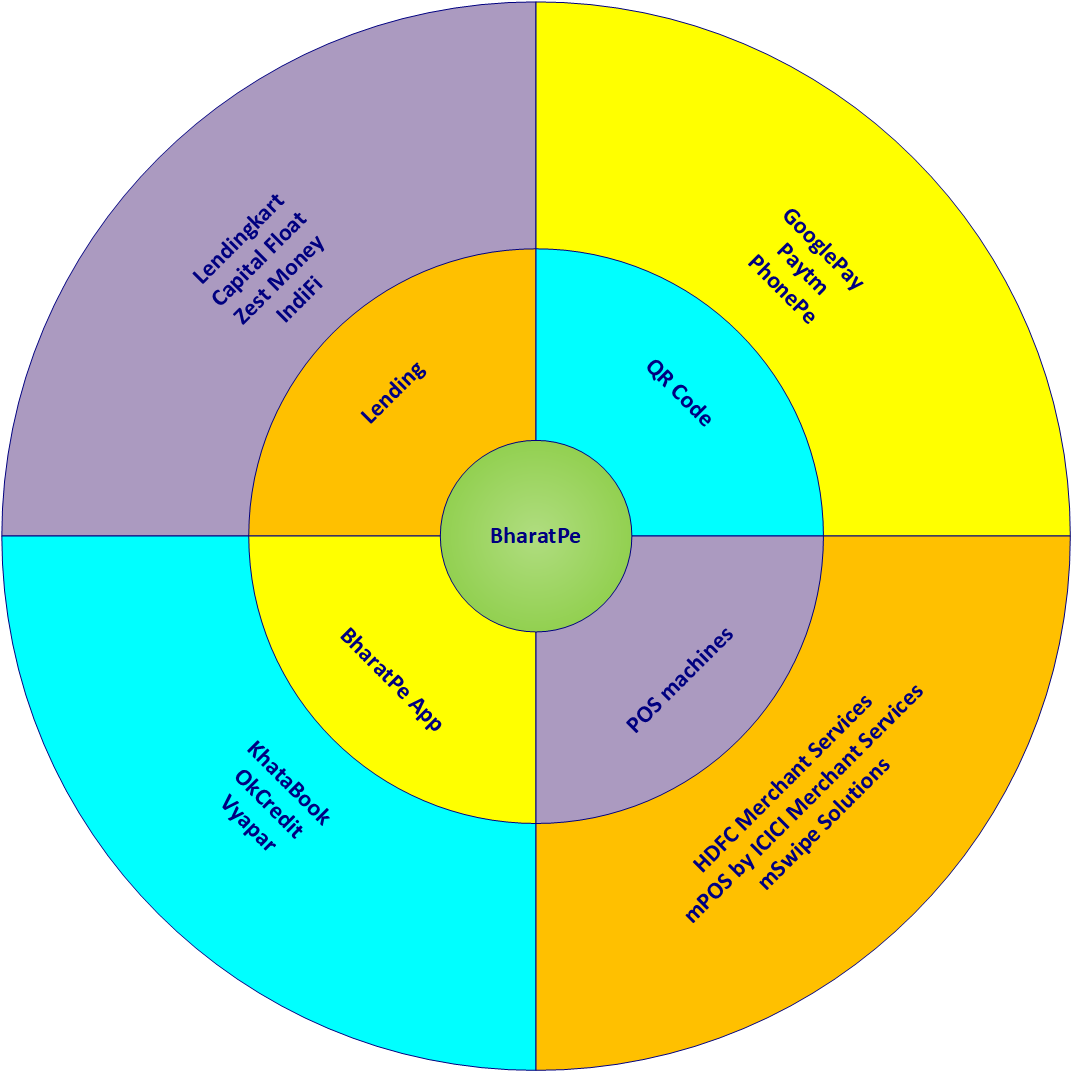

People use payment apps to pay shopkeepers. Paytm, PhonePe, Google Pay- all these companies have invested a lot in getting the maximum number of people to their app. But they ignored the shopkeepers. Just consider this fact- today there are more than 100 payment apps for people, but very few payment apps for shopkeepers.

Plus, online payments were unattractive for shopkeepers. Before UPI, online payments meant digital wallets. Whenever people paid shopkeepers using digital wallets like Paytm, the wallet took a cut. This cut into shopkeepers'’ margins and made their business less profitable (mind you, shopkeepers in India already operate at low margins). Even after UPI came, online payments were still a pain point for shopkeepers. All these big payment companies like Paytm and GPay and PhonePe wanted to protect their closed payments ecosystem. So they forced shopkeepers to keep different QR codes for different payment apps. This made life difficult for shopkeepers as they had to manage their transactions across so many apps. Plus, they still charged commissions from shopkeepers for processing payments.

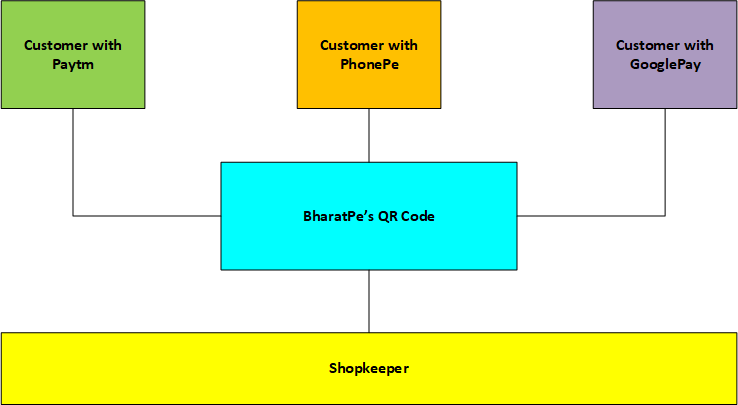

Here comes the shocker- UPI had already solved these 2 problems!! It had zero transaction charges(so shopkeepers wouldn't lose their margins), and it was interoperable(so one QR code could be used to accept payment from any payment app). Interoperability also meant that shopkeepers could use one payment app to track all their transactions and avoid the mess of using different apps. The problem was that shopkeepers weren't aware of these nice features.

None of the big payment companies wanted shopkeepers to be aware of these nice features. If shopkeepers came to know of zero transaction costs, companies would lose their cuts on every transaction. And if any of these companies told the shopkeepers about the interoperability feature, shopkeepers would delete their accounts from the other apps, and use only one. This would be a loss for all the companies as all of them would lose customers. You get the idea, right? These payment companies were too busy trying to protect their closed payment ecosystem on the merchant side.

BharatPe used the nice features of UPI to win over shopkeepers. It used UPI to remove the transaction charges. Then it made a common QR code that could accept payments from all payment apps. Shopkeepers loved this.

There was nothing new in this idea. They were just using the features UPI already had and were attracting shopkeepers. But it didn't matter. BharatPe was quite successful among shopkeepers. As the popular saying goes in the startup world- "Execution>>>>Ideas", BharatPe used a boring idea, and executed brilliantly on it.

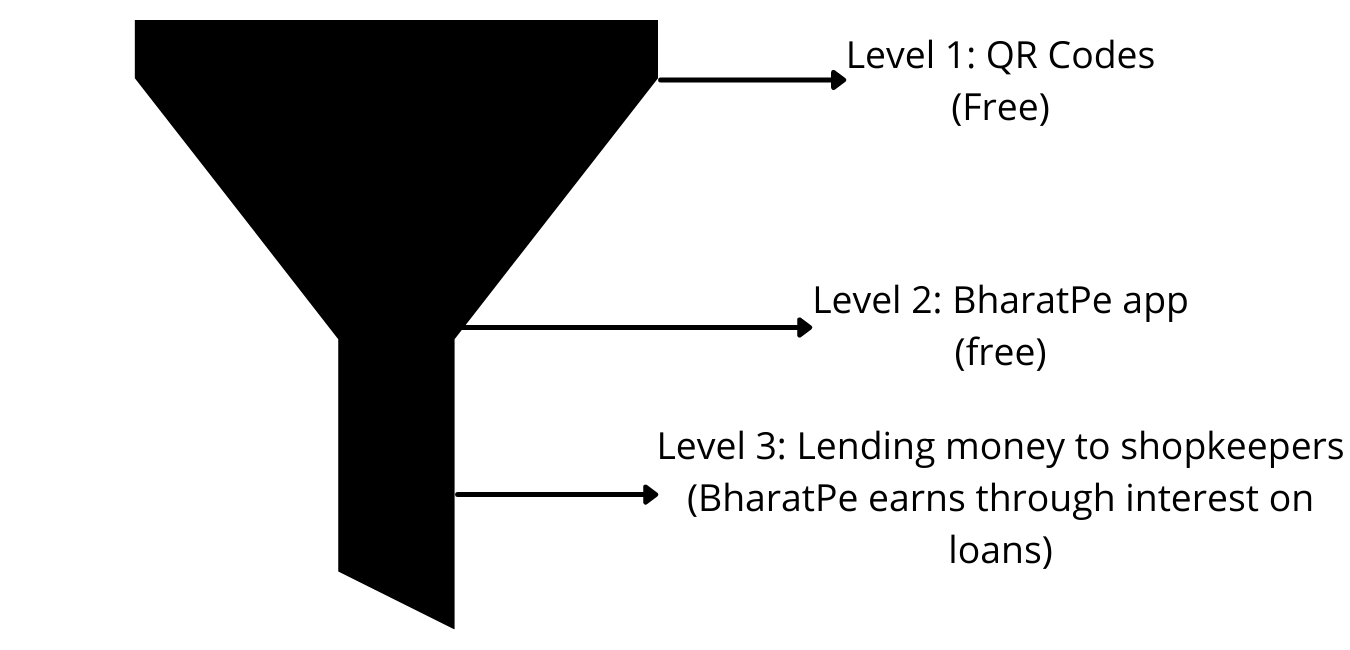

Keep this in mind- BharatPe didn't get any revenue with this QR code. (imagine asking shopkeepers to "buy" a QR code😂😂) They just gave away the QR code for free. They also didn't take a cut on transactions made using BharatPe QR. Do you get the point? They made zero revenue using the BharatPe QR code. If they made no revenue, then what was the point of QR codes?

They achieved something far more valuable with it. Shopkeepers were using BharatPe QR to accept payments and using the BharatPe app to track their transactions. So BharatPe had formed a network of shopkeepers. They had lots of data on the transactions of these shopkeepers.

🕹BharatPe's Business Model:

Monetizing this data was a problem. Shopkeepers wouldn't pay for the QR code or the app. Then BharatPe hit upon the best possible monetization strategy- lending. As co-founder Ashneer Grover said-

Shopkeepers were ready to pay interest on loans.

There is another benefit of lending money to shopkeepers:

Tens of millions of India’s small retail shops rely on personal relationships with wholesalers for credit. Bringing them under the ambit of formal lending will also draw them into the tax net, helping ease the resource crunch for a government that has seen its debt explode because of the Covid-19 crisis.

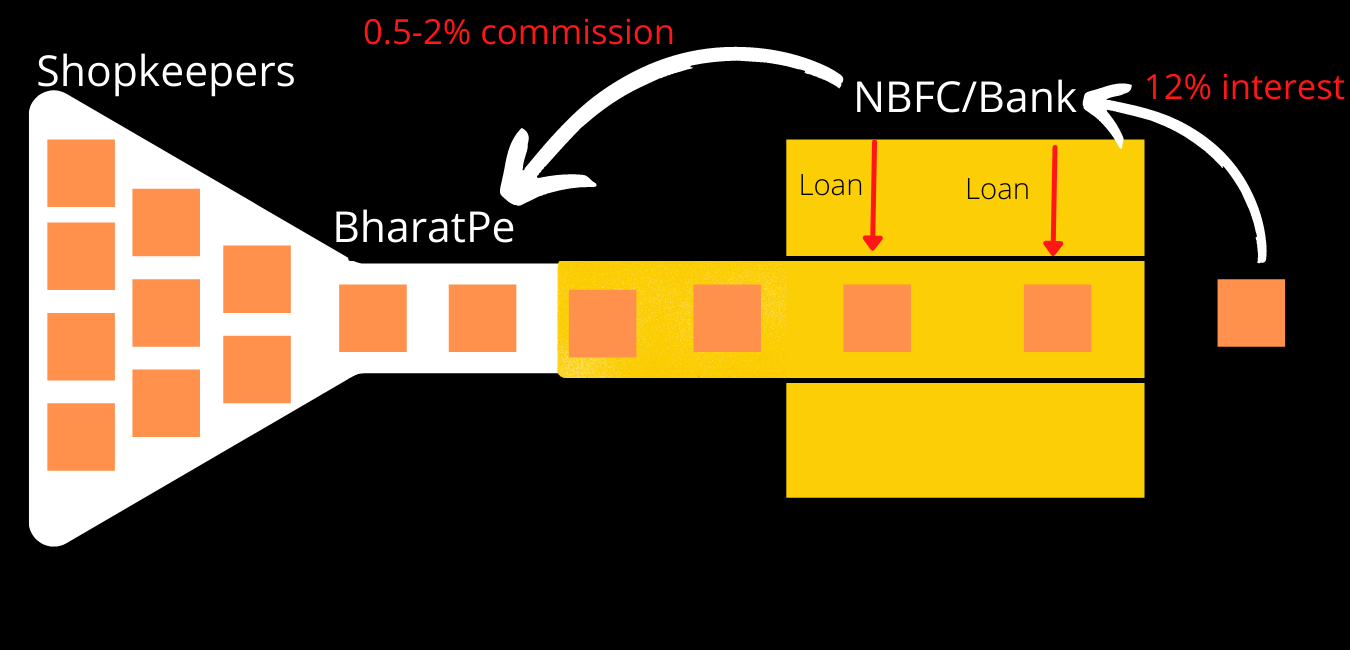

Here's how they used the shopkeeper's data for providing loans-

BharatPe has developed an artificial intelligence (A.I.)-based algorithm that picks up various signals—the kind of transactions a shopkeeper does, their usage of other products on the platform, etc.—which gives them an insight into the business’s cash flow. This is then analysed in tandem with the merchant’s loan history and credit score to make a loan offer.

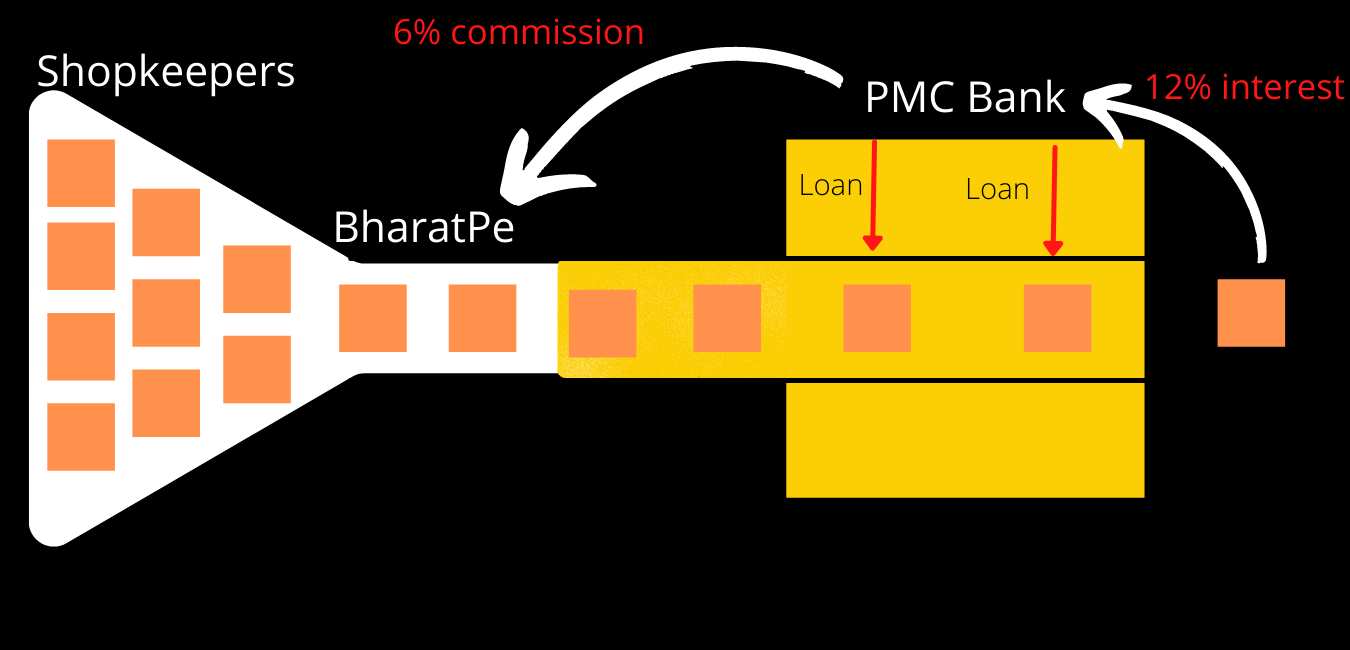

It depends on NBFCs(eg. Motilal Oswal and Muthoot Finance) and Banks to actually make these loans. Why? Because BharatPe does not have a license from the RBI- the "maibaap" of these matters. It acts as an agent for banks and NBFCs and gets a small commission(0.5-2%) from the loans.

For shopkeepers, taking a loan from BharatPe has one big advantage- BharatPe doesn't ask for collateral as the banks do. BharatPe uses its AI thingy to decide whether the shopkeeper will be able to repay the loan.

The business BharatPe is in, is good but not as profitable as a lending business. How is the lending business profitable, you ask? Think about it- you open a savings account or an FD with a bank, for instance. The bank pays you 4-6% interest on your deposit. Banks use this money to give loans to customers at about 8-12%. This means profit margins of 6-8%. Much more than the profits BharatPe earns as per the commission model!

That's where the PMC bank comes in.

Now, I am sure some of you might have a question- how does a scam-tainted bank come into the picture? You see, after the scam came to light, RBI had to act and act fast. They decide to put the bank up for sale. And the buyer? Centrum Group (which owns an NBFC) and BharatPe as equal partners! Centrum Group will form a Small Finance Bank (SFB) and merge PMC bank into the SFB.

As for BharatPe, it will be an equal partner to the new Small Finance Bank (SFB) that will come up. So now it can do all the banky stuff- accept deposits at 6-7% rate of interest, and lend them at 13%. So BharatPe's margins increase from 0.5% to 6%🔥🔥🔥

🕹BharatPe's competitors:

QR code and lending are not the only products from BharatPe. To further monetize their network, the company has launched a POS machine. BharatPe also has another lending product called P2P(peer-to-peer). In P2P, shopkeepers lend money to each other, and BharatPe acts as a middleman (remember the network of shopkeepers BharatPe had generated?). To achieve this, BharatPe has partnered with P2P NBFC's like LiquiLoans and LenDenClub.

🕹The Future: A True Neobank?

Now that BharatPe has the license for a Small Finance Bank, the next step would be a Banking License. A banking license will give BharatPe the power to become a vertically integrated neobank!

🕹This week, I wrote about-

The story behind Software-As-A-Service (Link: LinkedIn/ Twitter)

Goldman Sachs report on Reliance Retail (Link: LinkedIn/ Twitter)

The biggest goof-up in Google’s history (Link: LinkedIn/ Twitter)

Twitter has entered the beast mode (Link: LinkedIn/ Twitter)

I hope you found today’s article insightful and informative! This time, we made a lot of nice diagrams to help you understand the article better. Did you like them? Reply to this mail and let me know!

I’ve started writing on Twitter as well. Follow me there so that you don’t miss all these insights:

Thanks for being a supporter! Bye-bye and enjoy your day!!

This article is so cool 🔥🔥🔥.

Amazing explanation with very simple easy to understand visual diagrams.

Keep on posting these articles. 💖

That "maibaap" anology was amazing 😂

Again a really interesting and insightful newsletter ❤️