Running a cloud kitchen seems so easy, right?

Take orders online, cook the food, and deliver it to people. Easy🙂

Sadly, it’s not.

As I was reading about Rebel Foods, I realized running a cloud kitchen is so damn hard.

First of all, you have to innovate. A lot. They started with selling wraps but didn't stop there. They kept adding more items. Behrouz Biryani. Oven Story Pizzas. And then a whole list of other brands, all with one goal: become the best brand in that food category.

To ensure the success of each brand, they have a whole testing and development phase, just like tech companies do for products.

In fact, Rebel Foods uses more tech than tech companies: robots, IoT, machine learning, algorithms, etc etc.

Instead of engineers and PMs, they have brand managers and Culinary Innovation centers, and superchefs

And this is just the surface of this awesome startup. In 5 years, they have built 4000 restaurants and 14 brands!!

Amazing, right?

No other cloud kitchen in the world has figured out how to scale.

No other cloud kitchen has such a huge network as Rebel Foods.

In fact, Rebel Foods is probably the only company in the whole damn world to crack the cloud kitchen model.

Do you realize what this means?

Rebel Foods is in the rare category of Indian startups who have basically pioneered a category.

Most of our startups copy some idea from America or China and apply it to India. It works awesome, no doubt about that. Just look at Paytm and Flipkart.

But a startup that pioneers a category is rare. Remember my article about Apna? They were in this category of startups. They were the first ones to build such a huge network of blue-collar workers.

Rebel Foods is another. They are the first ones to crack the cloud kitchen model.

As Rebel founder Jaydeep Burman says:

We are the largest internet restaurant company in the world, by a wide margin. Some people tell us that this has not happened in the US, Europe or China, so it’s hard to believe that it could happen in India. After all, most of our tech stories are influenced / inspired by global companies.

In today's article, I'll tell you how Rebel Foods achieved this. Here's a brief outline of the article:

The beginning: Fassos, the fast food chain which flopped

The pivot: Dump the outlets, pump the cloud

The expansion: One kitchen, many brands

The scaling: 3500 restaurants in 5 years

The Future: AWS for cloud kitchens

Ready? Let's go🚀🚀

🕹️The beginning: Fassos, the fast food chain which flopped

In 2003, a 28-year-old guy called Jaydeep Burman who was working in Pune had a problem: he was missing home food. He was craving Bengali food, especially the rolls of Kolkata.

So, he teamed up with Kallol Banerjee and opened a fast food outlet on Pune's Dhole Patil Road. This outlet was called Fassos, and it sold rolls.

3 months later, they opened a second branch in Aundh. Fassos was profitable. Jaydeep quit his job.

But he didn't know how to grow the business. Plus, investors wouldn't fund a fast food shop.

So, he hired 2 people to run the shop and went to Insead business school in 2005, and then he got a job at McKinsey London in 2006 and became an associate partner by 2010.

By then, he had figured out the formula to grow Fassos: copy Dominos.

focus on delivery

specialize in a small number of food items

expand quickly

So he came to India, got $2 million funding from Sequoia(!!), and opened 18 Fassos shops in Pune, Mumbai, Bengaluru, Chennai, Delhi, and Ahmedabad.

In 2011, Jaydeep sent me a cold email with a concise, clear plan to turn Faasos into national quick-service chain that featured small-format restaurants and home delivery. We knew there was an opportunity for a large domestic brand in the fast food category. Jaydeep impressed us with his passion and clarity of thought. A term sheet was signed within 10 days of his first email.

In 5 years, Fassos was growing quickly. Revenue increased from Rs. 4 crores to Rs. 62 crore. There were 75 Fassos shops now in major cities.

But there was a big problem: losses.

Losses shot from From Rs. 2 crores to Rs. 105 crore in this same time period.

It seemed like copying Dominos was a bad idea.

Why?

Because building a restaurant chain is hard. Very hard.

Rent is expensive. The revenue from Fassos shops barely covered the rent.

Even a 100 square feet outlet in Kalina, Mumbai, had a monthly rent of ₹1 lakh.

Location decides success. Fassos shops needed to be in prime locations, otherwise, people wouldn't visit.

Building each Fassos outlet required lots of upfront money, but if the outlet wasn't successful, all that money went to waste.

The challenges of a retail network started compounding at scale – location failures, high rents for good locations and most importantly the difficulty in balancing dine-in and delivery customers from the same store network.

In short, Fassos was a flop.

🕹️The pivot: Dump the outlets, pump the cloud

The huge losses by Fassos were on top of Jaydeep's mind when he attended the Sequoia Entrepreneur Summit in Goa in 2014.

There, the great Doug Leone gave a great speech: how companies can learn about scaling from the universal laws of physics. He said that founders should find and remove friction from their businesses

Jaydeep began thinking: What was the friction for Fassos?

The outlets!

He realized that he would need to dump the outlets if he wanted to scale.

But how would Fassos survive if he dumped the outlets?

To find the answer to this question, he conducted a survey of Fassos customers.

Guess the result?

70% of them had never seen a Fassos shop!!

Most of them were ordering online!

This was a lightbulb moment

- Jaydeep

If so many people are ordering online and have never seen a Fassos outlet, why do you need physical outlets?

Thus, Jaydeep had his solution.

He shut down all Fassos shops which were in high-rent and prime locations

bought shops in areas that had less-rent and side locations

customers weren't allowed into these shops. they could only order online

these shops made the food(fassos wraps) and delivered it to people. this is the concept of cloud kitchen.

Thus, Fassos pivoted from a traditional fast food chain to a cloud kitchen.

Fassos opened 50 cloud kitchens in 4 cities that year.

Since Fassos only had to make and deliver the food, no need to pay high rent for prime locations. They could buy shops in cheap rent areas(like warehouses, basement, parking lot), make food there, and deliver it. Plus, they didn't need waiters or fancy decor. So, they saved a lot of money.

The shift from a traditional fast food format to a cloud kitchen model changed the economics of the entire venture.

The rent-to-sales ratio dropped from 15% to 4% over the next 2 years.

But more importantly it took away the need to solve the #1 problem of retail – finding great locations!

From finding locations, we moved to focusing on localities. This allowed the company to break the shackles of offline constraints and grow rapidly, without fear of mistakes.

🕹️The expansion: One kitchen, many brands

The year was 2016. Fassos had successfully pivoted to a cloud kitchen and was doing good business.

But it was still in the food business. So its problems were the same as traditional restaurants. And the biggest among these problems was food fatigue.

For example, I love dominos cheeseburst pizza with extra cheese and cheese dip, but I can't keep eating it every day. I'll get bored. This is called food fatigue.

Due to food fatigue, people don't like to order the same food again and again. That's why customer frequency is low in the food business.

For Fassos, people didn't like to eat wraps all the time. So they ordered from Fassos occasionally.

Jaydeep tried to solve this problem by expanding Fassos' menu to pizza and biryani. People eat these items more frequently than wraps, so theoretically, people should have ordered more frequently from Fassos.

But it flopped. People recognized Fassos for wraps, not pizza or biryani.

What next? How to solve the food fatigue problem? This was the question in front of a 2016 Fassos board meeting:

At a Q1 2016 board meeting, when the cloud kitchen model was in full swing, we had a long discussion about how to increase life time value of a customer by boosting average order value and improving frequency through wider choice.

The idea of launching a premium band, separate to Faasos, on the same platform was surfaced.

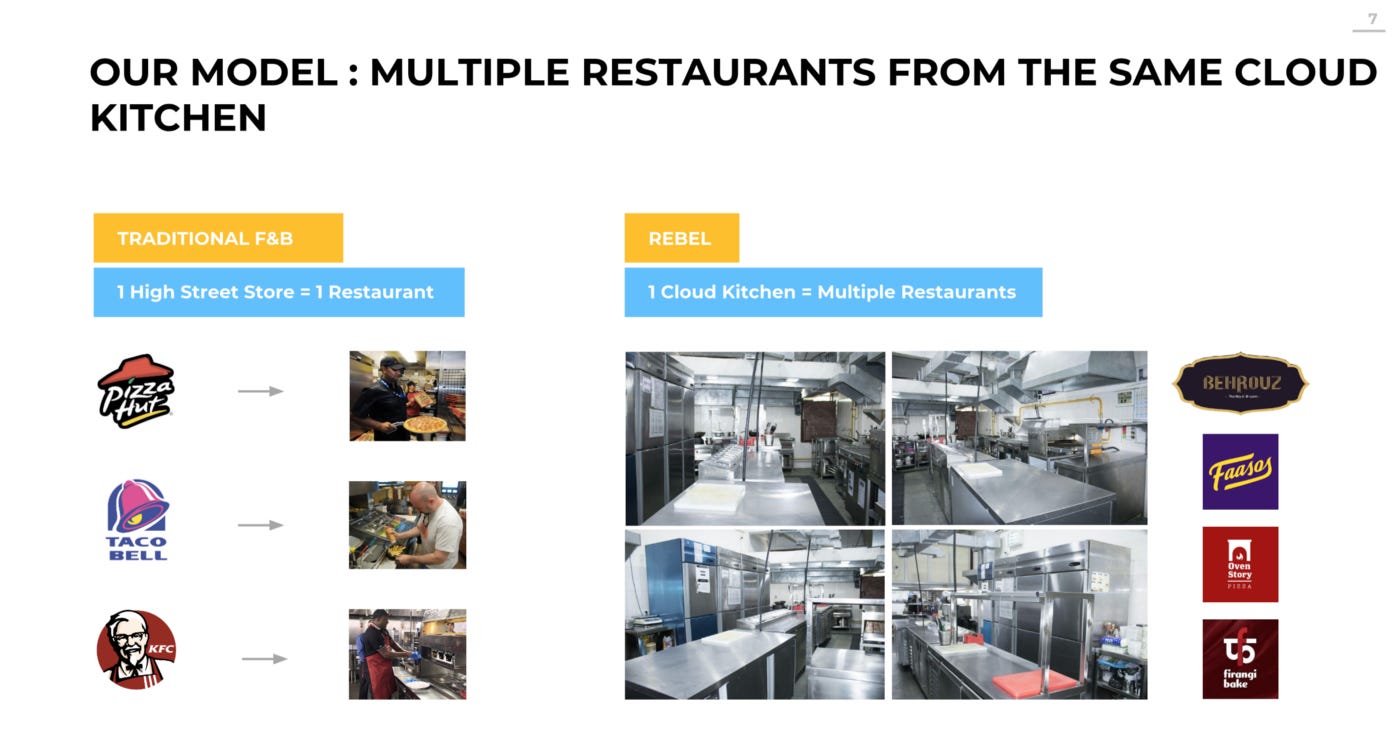

After some debate, everyone jumped on board: we could drive a lot of synergies by turning a cloud kitchen into a multi-purpose one.

It was a matter of creating a new brand, online, then using the same kitchen, common ingredients and the same staff to fulfil orders for different brands.

The cost of launching a new brand online was far lower compared to launching a new brand of offline stores and the cost of failure was even lower.

We could launch small across a few kitchens, target customers around those kitchens on the app+3rd party platforms, iterate the menu and get quick consumer feedback at relatively low cost and quick time.

The company did a small experiment to test this new idea.

It launched a new brand for pizza called Early Trails. The pizza was the same as Fassos one, just the name on the box was different. It worked. People started buying Early Trails pizzas.

Experiment successful✅

The main learning from this experiment?

The biggest takeaway was that there can’t be a multi-cuisine brand. McDonald’s is for burger, Starbucks is for coffee, and Domino’s is for pizza. Faasos has to stand for only one thing

So, Jaydeep decided to launch food brands separate from Fassos.

This decision transformed Fassos: from selling only wraps, they went to selling lots of different types of food.

First, they shut down Early Trails. Why? Because Pizza Hut and Dominos had a monopoly on pizza in India. Early Trails couldn't compete with these two. Basically, Early Trails was too early in this market😂

They needed a food category where no one had a monopoly. Biryani was selected. No company had a monopoly on biryani. Even better, there was no big biryani brand in India, so there was lots of potential in launching a biryani brand.

Thus, in 2016, Behrouz Biryani was launched.

Biriyani is a dish made across India, with myriad regional variations that have a lot of local love.

In August 2016 launched Behrouz Biryani, which was priced 2x above Faasos’ original wrap offering.

It tested well in the first set of locations, and quickly went national.

Within one year, Behrouz was delivering 200,000 Biriyanis a month.

In less than 18 months, the brand became a $12M business with minimal investments in marketing and capex.

And the brand started bringing a substantially different set of customers to the Faasos platform, thus expanding the market opportunity further.

Before I tell you about other Fassos brands, let's take a moment to understand the awesome strategy behind Behrouz.

Suppose if Dominos decided to launch a new biryani brand today. Even though there are so many Dominos outlets in every city, they will be useless for the new Dominos brand. The Dominos biryani brand would need a separate brand name, separate outlets, separate everything. Doing all this would be very costly for Dominos. That's why Dominos's menu doesn't expand beyond pizza too much.

But Fassos didn't have all these problems. It didn't have to open separate outlets in every city for Behrouz Biryani. They made the biryani in the same dark kitchens used by Fassos to make wraps. This saves so much money and makes scaling so much easier. This is why the cloud kitchen concept is so amazing!

Plus, Fassos could experiment with new types of food very cheaply. If they wanted to try to sell momos, they could just make momos in the same fassos dark kitchens. If people loved the momos, great! If not, try something else. No money gets wasted in trying out new experiments.

We launch a restaurant brand or product in only handful of kitchens, then include them on distribution channels, solicit feedback, iterate and iterate and iterate until we get both the product recipe and economics right.

But once we sense customers are loving it, we go crazy scaling it.

Our biryani brand, Behrouz Biryani, was built nationally in 18 months, riding on our network of existing cloud kitchens — today it’s the second largest biryani brand in India.

Plus, Behrouz attracted new customers and brought in more revenues:

With the success of Behrouz, we really began to understand the power of the cloud kitchen model.

Behrouz proved that a different brand, and story, can draw new customers and entice existing consumers to buy menu items at a higher price point – all delivered with the same infrastructure.

The cloud-kitchen model unshackled the company from several constraints of offline models. Location constraints, customer demographic constraints, scaling constraints - and even food fatigue - all evaporated.

After biryani, Fassos attacked pizza once again.

But this time, they were prepared to fight the Dominos-Pizza Hut monopoly.

In yet another study, consumers were asked to name the first thing that came to their mind after hearing pizza. Some 60 percent said cheese. No pizza brand, reckons Barman, was talking about cheese. “We launched four variants, and owned the space,” he says.

The pizza brand, Oven Story, became a $14 million brand and the 3rd largest Fassos brand.

Since they were launching so many brands, the company changed its name to Rebel Foods and Fassos became a brand under it. Today, Rebel Foods has more than 10 food brands:

🕹️The scaling: 3500 restaurants in 5 years

Anyone can start a cloud kitchen and launch several food brands. So why is Rebel Foods the only one that has successfully done so?

3 reasons:

👉 Supply chain:

Jaydeep calls the supply chain the main moat for Rebel Foods. They have built a country-wide supply chain that lets them move ingredients from one part of the country to another quickly. A wide network of warehouses to store raw materials and cooked food is an important part of the supply chain. Their cloud kitchens are equipped with all sorts of tech to cook the best quality food.

👉 Tech:

As I told you in the introduction, Rebel Foods uses more tech than tech companies. Here's the list of their tech:

visual artificial intelligence quality control machine to detect size, weight, appearance, and temperature for the food

robotics-led smart fryer, which gets adjusted automatically for the oil temp, dipping, and releasing based on what is being fried.

out of the door algorithms

inventory prediction based on consumption data

personal recommendation engine

polygon architecture for a multi-brand operation from a kitchen

automated cooking process

using technology to standardize biryani and take it all over the world

👉 Agile methodology for food innovation:

Just like tech companies use Agile methodology to quickly write and improve code, Rebel Foods has its own version of Agile to quickly develop and improve new food items.

They launch the new brand in a couple of test locations. Then, they keep improving the brand ratings, NPS scores, and brand economics until customers love it.

In the last 24 months, we launched and scaled 280 different menu items across brands, as we kept iterating to get the product-market fit right for each of the brands. This was possible because of our core team of super-chefs, who kept working relentlessly on delightful recipes.

If customers still don't love it, the brand is shut down. But if customers love it, Rebel Foods uses its supply chain power to take this new brand to the whole country.

In last 24 months, we launched at least 20 brands, but scaled only 7 pan India.

🕹️The Future:

Rebel Foods has a bright future. You probably already feel it by now.

In the future, they have 2 opportunities to grow even bigger.

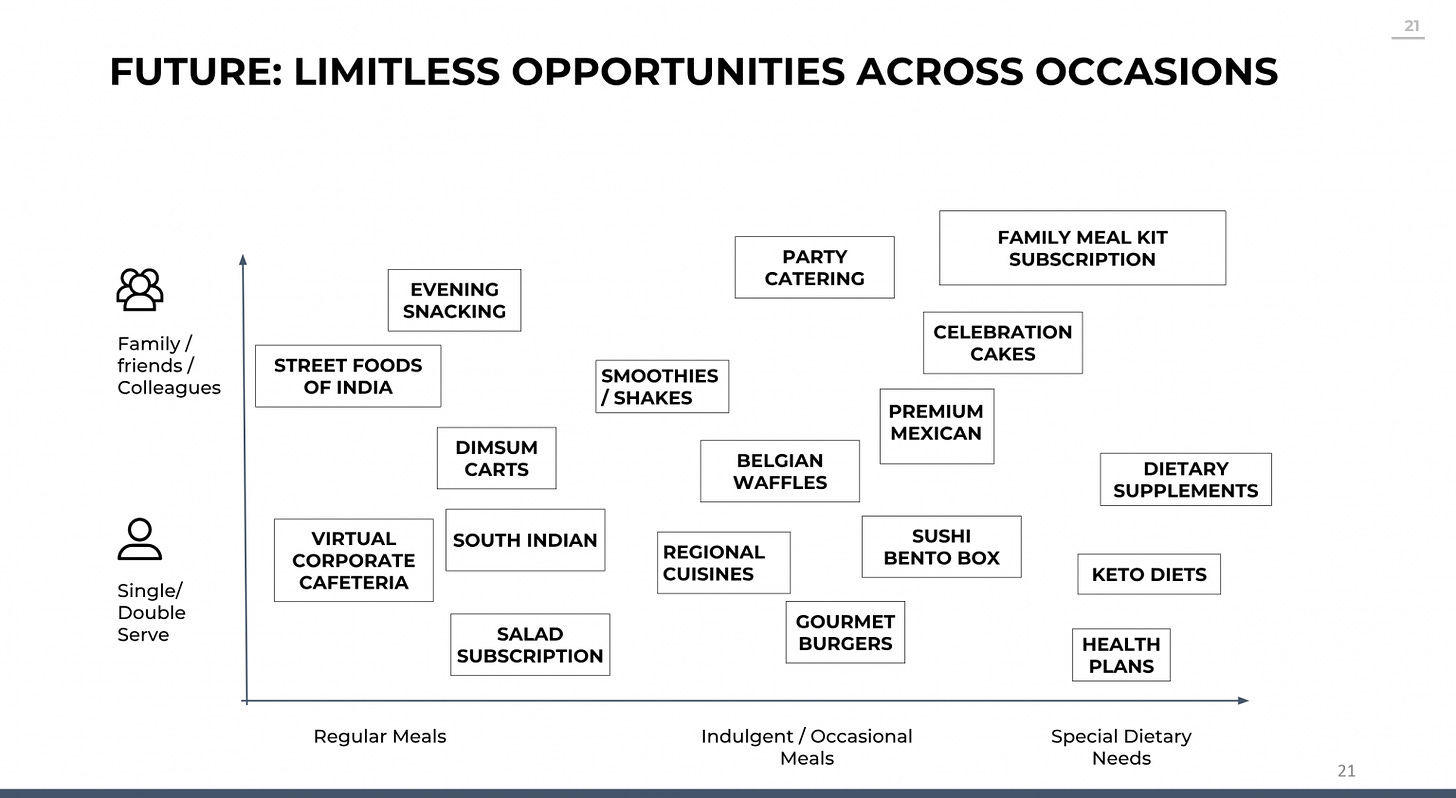

The first one is to continue what they are already doing: launch more food brands. Jaydeep has shared this image on his blog, it shows future food brands by Rebel Foods:

The second opportunity is more exciting: AWS for cloud kitchens.

They have a program called Rebel Launcher, in which, they use their cloud kitchen gyaan to help other companies establish cloud kitchens in India.

For example, they partnered with an American burger company called Wendy's to open 250 cloud kitchens in India.

Other international food brands like Natural Ice Cream, Mad Over Donuts, Baskin Robbins India, SLAY Coffee, The Belgian Waffle Company are also part of the Rebel Launcher.

For these international brands, partnering with Rebel is very beneficial. They get all the Rebel tech(robots and AI), supply chain(warehouses and cloud kitchens), and culinary skills.

Rebel Foods gets even more ROI on its cloud kitchen investment by selling it to these brands. That’s exactly what Amazon did with AWS did: sold its own cloud platform to other companies. Today, AWS is the most profitable division of Amazon with $13 billion profits last year!! Rebel Launcher has similar potential.

This wraps up today’s newsletter. I hope you enjoyed reading it.

If you enjoyed reading this article, please share it with your friends. I’m sure they will also find it informative:

And if you’re new here, please subscribe- you get weekly deep dives on Indian startups:

What are your thoughts on this article? Let me know👇

Follow me on Twitter for insightful threads:

Thanks for reading this newsletter and thanks for being a supporter! Bye bye and have a great day!

But having said that rebel foods...did not standardize indian regional food. It was difficult for them to scale up and touch base on Indian meat section. My part is to inform rebel foods to start with me indian meat base regional food which can be standardize and same time help reach tier 2 and tier3

Mast bhaiya