🕹️Thank you Govt of India for 30% crypto tax

The crypto tax is the best thing that could have happened to Indian crypto

This week was pretty big for Indian crypto:

Crypto community in India went bonkers after this announcement.

Many people rushed to buy crypto.

Many people rushed to sell crypto.

Crypto entrepreneurs were congratulating each other.

Twitter was filled with hot takes about the tax.

Many were confused about the details of the tax.

Many were shocked to see such a high tax.

Anti crypto people were wickedly happy to see the 30% tax. They started predicting the death of crypto.

So I decided to analyze the crypto tax and clear all confusion in today’s newsletter.

The story of 30% crypto tax has 3 actors: govt, crypto companies, and crypto hodlers. I’ll analyze the news from the point of view of each of them. No need to talk about the pov of anti crypto idiots, because they are ngmi.

Alright, let’s go🚀🚀

Small note: I’ve stopped putting the newsletter summary at the top.

The problem was, it was spoiling the suspense for you people. Earlier, you guys used to read the newsletter in anticipation of the insight.

But when I started putting the summary at the top of the newsletter, it spoiled the insight for you. That’s why I decided to stop the newsletter summaries.

Now, I’ve decided to do something much more difficult: I’ll make this newsletter so interesting and so engrossing that you will keep reading it till the end.

Today’s newsletter is my first attempt. Let’s see how it goes!

🕹️Govt’s POV:

People who are angry at govt for such a high crypto tax are forgetting one important thing: THE GOVT MENTIONED CRYPTO!!!

This small mention by govt will be a bigger boost to crypto than any crypto IPL ads.

After watching the budget, crores of Indians must be wondering crypto kya hota hai.

They are curious about crypto.

They are reading up about crypto.

They are thinking of investing in crypto.

They are trying out crypto apps.

This is exactly the boost Indian crypto needed.

Crypto startups have been trying to convince people to invest in crypto through IPL ads. But only the stamp of govt could provide this level of awareness about crypto.

So, thank you govt!

Onto the 30% tax.

30% tax is high, I agree.

But when I put myself in the govt’s shoes, such a high tax is 100% justified.

I’ll explain their thinking:

Finance Ministry Officer 1: Yo budget day is coming near. Nirmala mam is asking about ways to increase tax revenue. Do you have any ideas?

Finance Ministry Officer 2: umm...maybe increase tax on basic items?

Officer 1: in the middle of pandemic? lol dude people will kill us. We need to tax something big, something that hasn’t been taxed before.

Officer 2: Something big and untaxed? That sounds like crypto. Crypto in India is huge: WazirX had $43 billion trading volumes. And we don’t tax crypto.

Officer 1: Damn really?! Crypto is the perfect tax revenue for us! Lets tax it at 30%.

Officer 2: Why so high?

Officer 1: Dude just look how unpredictable crypto is. Prices of bitcoin, ether, etc fluctuate so much. Investing in crypto is like gambling lol. And we have 30% tax for all gambling items: betting, horse racing, etc.

Officer 2: oh ok. You go and tell Nirmala mam about this idea, I’ll go sell my bitcoin.

Now you understand govt’s pov? Crypto is too big for govt to not tax it. And because crypto is so unpredictable, govt is taxing it just like gambling.

There has been a phenomenal increase in transaction in virtual digital assets. The magnitude and frequency of these transactions have made it imperative to provide for a specific tax regime

-Nirmala Sitharaman, Finance Minister.

This is not only for crypto, this is for all speculative income. For example, if I take horse racing, that also attracts 30% tax. There is already a 30% tax on any speculative transaction. So we have decided to tax crypto at the same rate. Crypto is a speculative transaction, so we are taxing it at a 30% rate

-TV Somanathan, Finance Secretary

But remember: taxing crypto doesn’t make it legal.

Only the parliament has the power to legalize crypto legal. Some brave person will introduce the bill, the members will debate it, maybe it passes, maybe it doesn’t.

But the finance ministry couldn’t keep waiting for the parliament’s decision. So they put crypto in a gray area and introduced a 30% tax.

Crypto in a gray area means it is not legal, not illegal, somewhere in the middle. Parliament will decide whether to put crypto in a legal or illegal area, but until then, finance ministry will happily collect its 30% tax.

I don't wait till regulation comes into place taxing people who are earning profits, Can I?” -Nirmala Sitharaman

But now that finance ministry has put crypto in a gray zone, will the parliament really ban crypto?

Imagine you are sitting in the parliament seat, and now read this headline:

1000 crore revenue from just 1% crypto tax!! Just think of the revenue from the whole 30% tax!!

Will you really ban such a lucrative source of tax revenue? Or will you legalize it and promote it?

This, my friends, is the biggest benefit of the 30% crypto tax: full legal status to crypto.

While other countries are scared of crypto, our country has gotten a taste of crypto’s benefits. While other countries are banning crypto, we are embracing it.

The 30% tax is the first step towards becoming a crypto nation.

The introduction of CBDC is the second step. CBDC matlab govt’s own cryptocurrency.

The budget announced that RBI will launch CBDC next year.

This is a smart move by the govt. Cryptocurrency has 2 use-cases: 1) currency and 2) asset class.

Govt wants control over the currency use case. That’s why they are introducing the CBDC. Plus, the 30% tax will make sure no one uses other cryptos for currency use cases. Govt is treating all other cryptos as assets.

Having a centralized cryptocurrency goes against the mission of cryptocurrencies, but that is a problem for tomorrow. For today, I’m just grateful that our govt is so supportive of crypto.

🕹️Crypto companies’ POV:

Crypto companies were afraid that customers would sell all their crypto and go to stock market. But the opposite happened:

30-50% jump just because of one mention in the budget!! Now you understand the power of 30% crypto tax?

This is just the beginning. I see much bigger benefits because of this 30% tax.

Crypto’s biggest negative, “its illegal”, is gone. The 30% tax and CBDC show that govt recognizes and supports crypto.

This is big marketing ammunition for crypto companies. They can shout about this on all tv and newspaper ads. No more stigma or fear of investing in crypto.

More people will be eager to try crypto.

More people will be eager to work in crypto.

More people will be eager to startup in crypto.

More investors will be eager to fund crypto.

More banks will be eager to partner with crypto.

Sure the 30% tax is bad, but crypto startups are already on it: The Blockchain and Crypto Assets Council is working with authorities to reduce the tax.

Their goal is to bring the tax like other asset classes like stocks.

🕹️Crypto Hodlers POV:

Hodlers were very angry at the 30% tax.

A petition to reduce the tax was started 3 days ago and has got 65,000+ signatures:

The hashtag reducecryptotax started trending on Twitter.

Crypto entrepreneurs requested govt to reduce the tax:

People were angry that govt is treating crypto like gambling and betting.

They are angry that while stocks and mutual funds get 15% tax, crypto is getting 30% tax.

They are angry at all the fees they will have to pay.

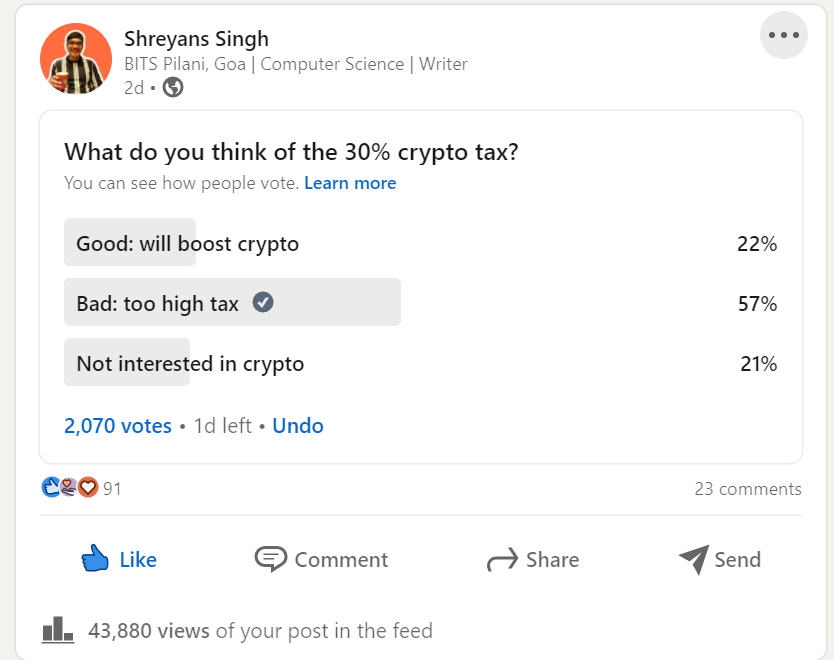

I did a LinkedIn poll, and 57% said crypto tax is bad:

But in front of all the positives of crypto tax, these are just minor problems.

I believe 30% tax will be reduced very soon. Here’s why:

the crypto bill will legalize crypto and tax will be reduced

the volatility of crypto will die down soon, and it won’t be treated like gambling anymore

In fact, this high tax is a big blessing.

We are hodlers. We are playing the long game. We won’t be selling our crypto anytime soon. So no need to worry about the tax.

The only people who should be scared are the “crypto traders”: people who came into crypto to get rich quick. I’m sure they ran away from crypto as soon as they saw the 30% tax news. Bye bye these short term thinkers.

Even better, crypto will have strong investments from institutional investors(very rich people, corporates, funds, etc). These people make solid investments and hodl for a long time.

More people will realize the power of crypto and join us and our community will get stronger💪💪

I felt bad that I couldn’t send the newsletter last week, so I did double hard work on this newsletter. How was it? Let me know in the comments, or you can just reply back to this email.

If you enjoyed reading this article, please share it with your friends:

And if you’re new here, please subscribe- you get weekly insights on the Indian startup ecosystem:

🕹️This week, I also wrote about:

Thanks for reading this newsletter! Bye bye and have a great day!

The GOI is taking a very interesting approach. While it doesn't want to outright ban crypto like the Chinese, neither it is going towards the all acceptance mode like Ecuador. Taxing it may pave the way for legal acceptance with regulations at a future date.

Wooaaa!!! Excellent analysis! Amazingggg Insights🔥🙌💡💡💡

I became lazy and stopped reading newsletters, which I now believe was a mistake.

But it's fine now that I'm back at it.

In addition, I found today's newsletter to be far more fascinating than previous ones.

As you stated at the outset, you will not give a summary and will instead allow the anticipation to build.

Thank you for the amazing hard work and dedication, Shreyans😄❤️